Projecting cash flow can drastically help a business succeed. Here are the steps that can help your business come out on top.

Cash Planning

Profit and Loss statements are nice, but at the end of the day what truly matters is cash flow. Cash is King! Best practices tell us to manage our collections aggressively, keeping them as close to 30 days or less, if possible. Focus on customers that pay promptly. Make sure that service and customer support is superior to these customers. Payables are a great source of cash (working capital) and should not be paid too soon. In tough times forty-five days is typically a good benchmark. If necessary, renegotiate your payment terms. This can be done as part of the negotiation for better pricing on your raw materials. Stay between 45 and 60 days at Max.

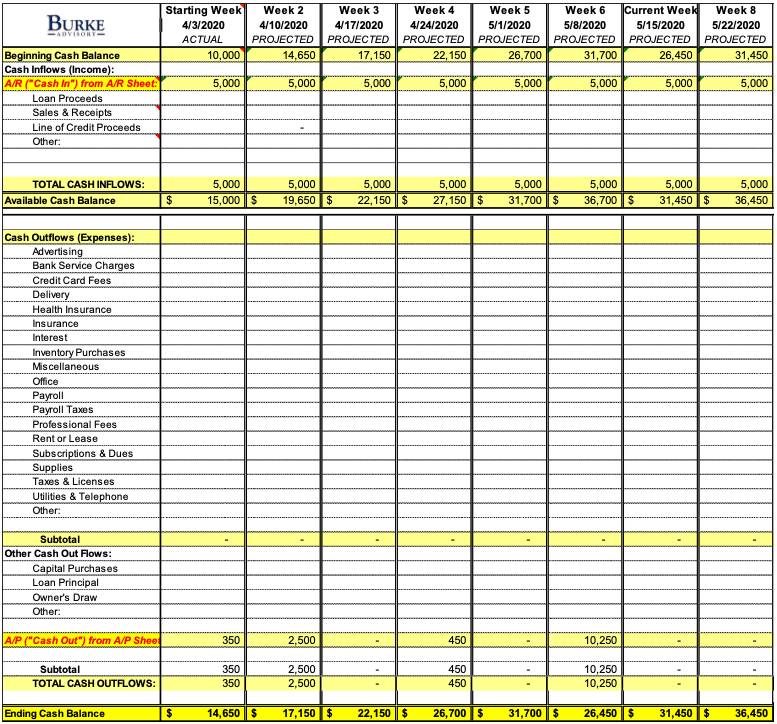

Sample 13-Week Cash Forecast Analysis

Develop an Accurate Forecast

Accurate 13-Week Cash Forecast Analyses (13WCFA) are used all over the world for healthy companies and those in crisis to manage short-term cash needs. Analyze your account registers for all payments you have made for the last 60 days. Break them down on a spreadsheet by week. This should give you a good idea of what your weekly spending typically is. You will notice that many of your payments are approximately the same each month. Project those forward for the next 13 weeks. By projecting the receipt of your accounts receivable forward on a weekly basis using historical payment patterns, we can predict future incoming cash flow. By projecting payables forward, based on your payment terms, we can predict future outgoing cash flow. Using this format allows us to plan our cash flow much more effectively. We can make adjustments on purchases and payments accordingly. There are many templates available for this traditional 13-week cash flow plan. This one is available for free. This analysis is a dynamic document and should be updated once or twice per week.

Watch out for timing differences. For example, if your payroll is every two weeks, you may have a couple of months with three payrolls. The more your business is in the state of flux, the more attention to detail will be needed in the analysis. If your company is large enough, you may need to prepare separate 13WCFA projections for separate business units. Needless to say, just the preparation and review of this analysis will yield strategic insights into your business that will prove valuable.

Once you have the tool up and running you will see how you can move expenses around to maximize positive or break-even cash flow.

I wish you the very best of luck!

Burke Advisory

March 30, 2020

Kevin Burke is a member of the Turnaround Management Association and a Certified Turnaround Professional. A graduate of the Villanova School of Business, he has over 35 years of experience in banking and executive management. His management consulting practice is located in Troy, Michigan.